As our global population ages, long-term care (LTC) has become an increasingly important topic for individuals and families alike. Long-term care involves a range of services designed to meet a person’s health or personal care needs over an extended period. Planning ahead for LTC is crucial to ensure quality of life and peace of mind. Understanding who may require long-term care and recognizing the signs early can make a significant difference in the well-being of loved ones.

What Is Long-Term Care?

Long-term care encompasses a variety of services aimed at assisting individuals who can no longer perform everyday activities independently. These services include:

- Medical Care: Ongoing medical treatment and supervision.

- Personal Care: Assistance with daily activities like bathing, dressing, and eating.

- Emotional Support: Counseling and social activities to support mental health.

Unlike short-term recovery care, which is temporary and focuses on rehabilitation after an illness or surgery, long-term care is often ongoing and caters to chronic conditions or progressive illnesses.

Common Reasons for Needing Long-Term Care

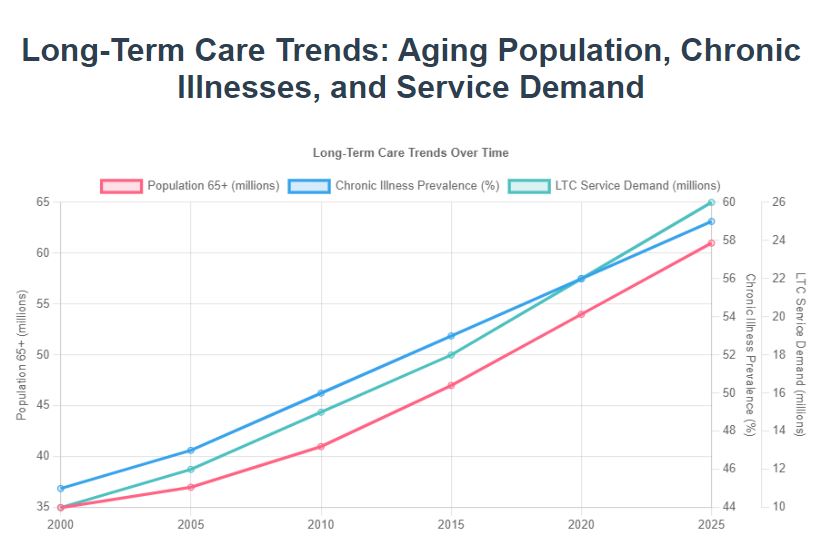

Aging Population Statistics

- Increased Longevity: People are living longer due to advancements in healthcare.

- Elderly Population Growth: The number of individuals aged 65 and older is projected to double by 2050.

- Higher Risk of Health Issues: Aging increases the likelihood of chronic conditions requiring LTC.

Chronic Illnesses and Disabilities

Individuals with chronic illnesses such as diabetes, heart disease, arthritis, or disabilities may need assistance with daily tasks and medical management.

Recovery from Surgery or Illness

Post-operative care or recovery from severe illnesses like stroke may necessitate continuous medical supervision and rehabilitation services.

Early Signs That Someone May Need Long-Term Care

Difficulty with Daily Activities

- Struggling with Self-Care: Challenges in bathing, dressing, grooming, or feeding oneself.

- Household Management Issues: Difficulty managing finances, cooking, or cleaning.

Memory Issues or Cognitive Decline

- Forgetfulness: Missing appointments or misplacing items frequently.

- Confusion: Difficulty following conversations or instructions.

- Safety Concerns: Leaving stoves on or wandering off.

Frequent Falls and Mobility Issues

- Balance Problems: Unsteadiness while walking.

- Increased Accidents: Bruises or injuries from falls.

- Need for Mobility Aids: Reliance on walkers or wheelchairs.

Increased Medical Supervision

- Complex Medication Regimens: Difficulty managing multiple prescriptions.

- Chronic Health Conditions: Frequent hospitalizations or medical interventions.

- Need for Specialized Care: Requirements for therapies or treatments.

Who Typically Requires Long-Term Care?

Elderly Individuals

Aging is the leading cause of long-term care needs due to:

- Natural Decline in Physical Abilities: Reduced strength and endurance.

- Cognitive Impairments: Increased risk of dementia and Alzheimer’s disease.

- Chronic Health Conditions: Greater prevalence of illnesses requiring ongoing care.

People with Chronic Illnesses or Disabilities

Conditions such as:

- Parkinson’s Disease

- Multiple Sclerosis (MS)

- Rheumatoid Arthritis

These illnesses can make daily tasks challenging and may progress over time, increasing the need for assistance.

Individuals with Cognitive Decline

- Alzheimer’s Disease

- Dementia

- Other Cognitive Impairments

Memory care and specialized services become essential for safety and quality of life.

People Recovering from Major Surgeries or Medical Events

- Stroke Survivors

- Joint Replacement Patients

- Cancer Patients

Extended rehabilitation and support may be necessary to regain independence.

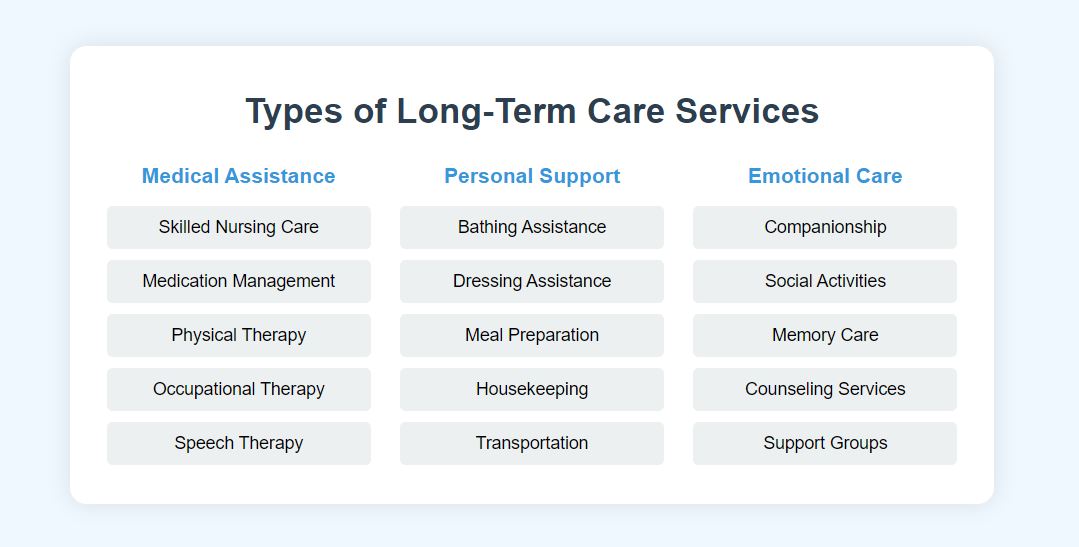

Types of Long-Term Care Services Available

In-Home Care

- Personal Aides: Assist with ADLs (Activities of Daily Living).

- Visiting Nurses: Provide medical care at home.

- Home Health Services: Include physical therapy, wound care, and monitoring.

Assisted Living Facilities

- Housing with Support Services: For those needing some help but not full-time care.

- Social Activities: Promote community engagement.

- Meals and Housekeeping: Included in the services.

Nursing Homes

- 24/7 Medical Care: For individuals with significant health conditions.

- Skilled Nursing Staff: Provide comprehensive medical attention.

- Rehabilitation Services: Physical, occupational, and speech therapy.

Memory Care Units

- Specialized Care: For individuals with dementia or severe cognitive decline.

- Secure Environment: Ensures safety and reduces wandering.

- Therapeutic Activities: Tailored to cognitive abilities.

Palliative and Hospice Care

- End-of-Life Care: Focused on comfort and quality of life.

- Pain Management: Alleviating symptoms.

- Emotional and Spiritual Support: For patients and families.

Financial Planning for Long-Term Care

Overview of LTC Costs

- In-Home Care: Average $4,500 per month.

- Assisted Living: Approximately $4,300 per month.

- Nursing Homes: Ranging from $7,500 to $8,800 per month depending on room type.

Costs vary by location and level of care required.

Long-Term Care Insurance

- Coverage: Helps pay for services not covered by regular health insurance.

- Consideration: Best purchased before health issues arise to lower premiums.

Government Programs

- Medicaid: For low-income individuals; covers nursing home care.

- Medicare: Limited coverage; primarily short-term care.

- Veterans Affairs Benefits: For eligible veterans and spouses.

Personal Financial Strategies

- Savings and Investments: Setting aside funds specifically for LTC.

- Asset Management: Selling assets or using home equity.

- Annuities: Financial products that provide steady income.

How to Assess Long-Term Care Needs

Tools and Resources for Evaluation

- Activities of Daily Living (ADLs) Assessments: Evaluate ability to perform basic tasks.

- Instrumental Activities of Daily Living (IADLs): Assess more complex functions like managing finances.

Family Discussions

- Open Communication: Discuss preferences and concerns early.

- Involving Loved Ones: Ensure everyone’s views are considered.

Working with Healthcare Providers

- Medical Evaluations: Doctors can provide insights into future care needs.

- Specialist Consultations: Neurologists, geriatricians, or therapists may offer valuable assessments.

Red Flags to Watch For

- Neglected Personal Hygiene

- Unexplained Weight Loss

- Isolation from Social Activities

- Frequent Emergency Room Visits

Steps to Take After Determining Long-Term Care Is Needed

Finding the Right Long-Term Care Provider

- Research Options: Visit facilities or interview in-home care agencies.

- Check Credentials: Ensure providers are licensed and have good reputations.

- Consider Special Needs: Look for facilities that cater to specific conditions.

Understanding Legal Considerations

- Powers of Attorney: Designate someone to make decisions if incapacitated.

- Living Wills: Outline medical treatment preferences.

- Guardianship: Legal responsibility for someone unable to care for themselves.

Making the Transition to Long-Term Care

- Emotional Support: Acknowledge feelings of loss or anxiety.

- Logistical Planning: Arrange for moving, transferring medical records, and setting up finances.

- Personalizing the Space: Bring familiar items to make the new environment comfortable.

Building a Support Network

- Family Involvement: Regular visits and communication.

- Community Resources: Support groups or volunteer organizations.

- Professional Counseling: For both the individual and family members.

Long-Term Care Myths and Misconceptions

Myth: Long-Term Care Is Only for the Elderly

- Fact: Younger individuals with disabilities or chronic illnesses may also require LTC.

Myth: Long-Term Care Is Always in a Nursing Home

- Fact: Many receive care at home or in assisted living facilities.

Myth: Insurance Will Cover All LTC Expenses

- Fact: Traditional health insurance often doesn’t cover long-term care; specific LTC insurance or government programs are needed.

Benefits of Planning for Long-Term Care Early

Financial Preparation

- Cost Savings: Early planning can reduce expenses.

- More Options: Greater choice of facilities and services.

Avoiding Crisis Decision-Making

- Proactive Approach: Prevents rushed decisions during emergencies.

- Informed Choices: Allows time to research and select the best care.

Peace of Mind for Families

- Reduced Stress: Knowing plans are in place eases anxiety.

- Clarity of Wishes: Ensures loved ones’ preferences are respected.

Conclusion

Recognizing who may need long-term care and planning accordingly is essential for the well-being of individuals and their families. Early assessment and financial preparation can make the transition smoother and ensure that quality care is accessible when needed.

If you or a loved one may require long-term care, take the first step toward peace of mind by exploring compassionate care options.

Visit Healed Care Home to discover personalized long-term care services tailored to meet individual needs. Start the conversation today and let our dedicated team assist you in planning for a higher quality of life.